WTI Holds Losses After API Reports Large Surprise Gasoline Inventrory Build

Crude prices slipped back lower today from two-month highs, testing back into the range of the last couple of days after rallying hard on increasing geopolitical tensions.

A series of drone attacks last week on Russian oil infrastructure by Ukraine, combined with escalating tensions between Iran-backed Hezbollah and Israel have buoyed crude prices, Claudio Galimberti, director of global market analysis at Rystad Energy, said in a note.

“Against a backdrop of escalating geopolitical tensions, including conflicts in the Middle East and the ongoing war between Russia and Ukraine, Brent surpassing $85 per barrel could be the start of more upward pressure on prices,” he said.

Today’s decline (perhaps driven by weaker sentiment and confidence data) did not appear to change the trend, but tomorrow’s official inventory data (which we get a hint at tonight from, API) may change things…

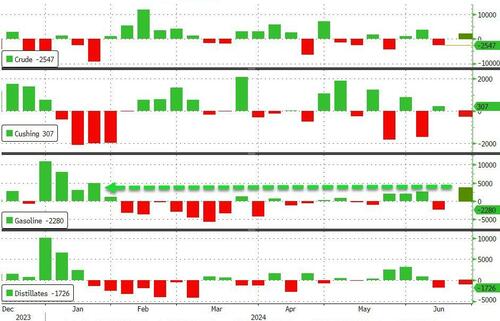

API

-

Crude +914k (-200k exp)

-

Cushing -350k

-

Gasoline +3.84mm (-900k exp) – biggest build since Jan 2024

-

Distillates -1.18mm

Crude stocks rose modestly last week, against expectations of a small draw but gasoline stocks surged according to API…

Source: Bloomberg

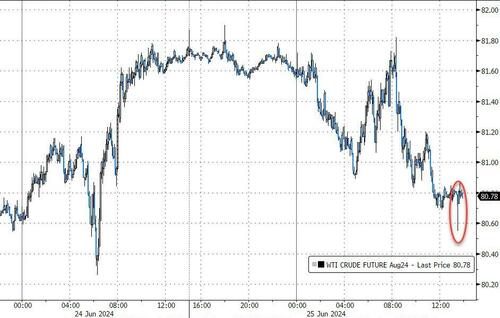

WTI was trading around be $80.80 ahead of the API data and dipped on the crude build before coming back…

Source: Bloomberg

Finally, despite the decline and the builds, there are signs of strong summer demand in the Northern Hemisphere (after earlier jitters over a shaky start to the U.S. summer driving season, which runs from Memorial Day to Labor Day).

Galimberti said expectations for a summer surge in fuel demand have been aided by strong growth in aviation. Jet fuel is expected to see an increase in demand of 550,000 barrels a day, according to Rystad, after a 1.2 million barrel-a-day jump last year.

“For the time being, this strength in aviation activity signals a positive trend for oil demand, particularly in the context of summer travel, economic recovery and consumer optimism,” he wrote.

Analysts at JPMorgan Chase & Co. on Tuesday maintained a forecast that Brent would average $84 a barrel in the third quarter and hit $90 by August or September, “underpinned by our expectations that global demand will outpace supply in the summer quarter.”

Meanwhile, analysts at Macquarie revised their Brent third-quarter forecast up to $86 per barrel, from $83, on projections of rising demand.

Tyler Durden

Tue, 06/25/2024 – 18:00