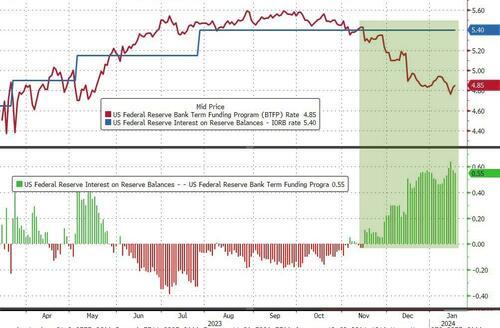

With The Fed having practically lost control of their bank bailout facility (BTFP) due to banks pilings 10s of billions into a free-money arbitrage in recent weeks (enabled since Powell pivoted)…

Source: Bloomberg

…it was no surprise they pushed back a little yesterday, hoping to encourage (wean off) banks to use the discount window instead – because the $161BN BTFP will go extinct in March.

Source: Bloomberg

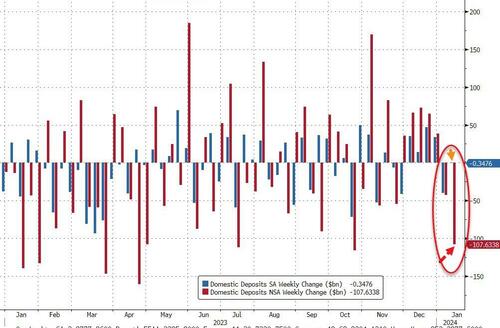

Amid all this free-money for the banks, total deposits (seasonally-adjusted) fell for the second week in a row (down $12.3BN)…

Source: Bloomberg

On a non-seasonally-adjusted basis, banks have seen deposit outflows of $111BN in the first two weeks of 2024…

Source: Bloomberg

And Fed Fuckery is back on display…

Excluding foreign banks, Domestic bank deposits plunged $107BN (NSA) last week (Large banks MSA -$87.3BN, Small banks NSA -$20.3BN), while they were practically unchanged on an SA basis -$348MN (Large banks SA +5.13BN, Small banks SA -$5.48BN)…

Source: Bloomberg

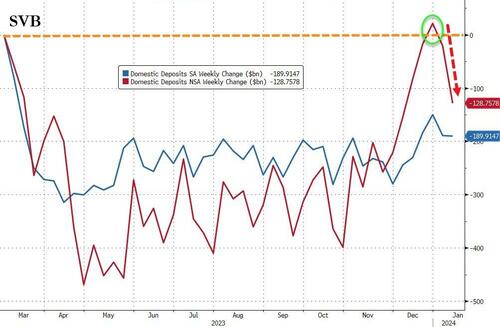

Interestingly, since NSA domestic deposits reached their pre-SVB levels, they have seen major outflows…

Source: Bloomberg

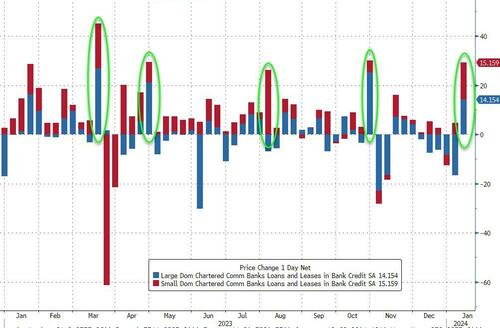

On the other side of the ledger, loan volumes surprisingly (given the deposit outflows) surged back last week with large bank loan volumes up $14.2BN (the first rise in loans in 6 weeks) while Small Banks saw loan volumes up $15.2BN on the week…

Source: Bloomberg

All of which means – as we pointed out previously – “March will be lit”…

March will be lit:

1. Reverse repo ends

2. BTFP expires

3. Fed cuts (allegedly)

4. QT ends (allegedly)— zerohedge (@zerohedge) January 8, 2024

Because without the help of The Fed’s BTFP, the regional banking crisis is back bigly (red line), and large bank cash needs a home – green line – like picking up a small bank from the FDIC…

Source: Bloomberg

And now you know why The Fed will cut rates in March – no matter what jobs or inflation is doing.

Tyler Durden

Fri, 01/19/2024 – 16:40

_4.png?itok=DsO3bOTd)