Existing home sales beat (bouncing modestly off record lows), consumer confidence jumped (as inflation expectations declined and labor market conditions worsened), but earnings reports from FedEx and General Mills threw some cold water on the ‘resilient’ consumer, cyclical rebound narrative.

And it’s the commentary from Corporate America that has us wondering:

Did the Goldilocks narrative just die?

-

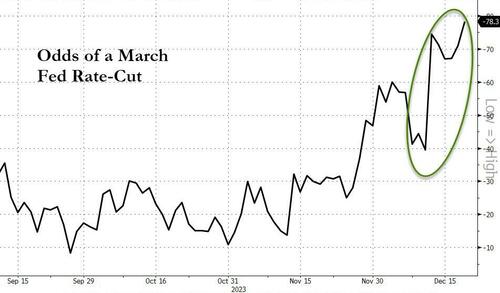

March rate-cut odds soared

-

Rate-cut expectations for next year surged

-

Stocks puked

-

Bond yields plunged across the curve

-

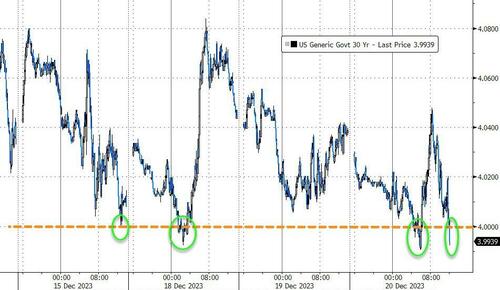

30Y yields broke below 4.00% – the first close below 4.00% since July

That smells a lot like a ‘recession’ trade to us as it’s not the Fed’s post-Powell jawboning to walk-back the market’s dovishness (because rates shifted dovishly).

Fed’s Harker was a little more dovish than the recent walkback-of-Powell’s comments by various Fed speakers, but still pushed off any imminent rate-cuts:

“It’s important that we start to move rates down,” Harker said Wednesday in a local radio interview.

“We don’t have to do it too fast, and we’re not going to do it right away.”

Rate-cut expectations for March surged to new cycle highs this morning…

Source: Bloomberg

And expectations for rate-cuts next year re-accelerated dovishly, shrugging off all the FedSpeak of the last week, trying to walk-back what Powell did…

Source: Bloomberg

The Dow ended its streak of losses at 9 days, as the S&P suffered its biggest decline since October…

Starting around 1430ET – margin-call time…

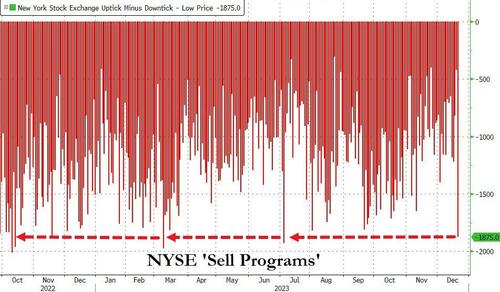

…the biggest sell-program since July smashed stocks lower…(and that was followed quickly by a large buy program)…

Source: Bloomberg

For context, this size of selling pressure is unusual…

Source: Bloomberg

Did the L/S funds finally get tapped on the shoulder…

hedge fund carnage pic.twitter.com/8TTBkV9l1V

— zerohedge (@zerohedge) December 14, 2023

Or was this why we puked?

Wall Street’s Biggest Bear Mike Wilson Finally Capitulates: “Equities Have The Green LIght To Ramp Higher” https://t.co/qGezeslRR3

— zerohedge (@zerohedge) December 19, 2023

‘Most Shorted’ stocks were clubbed like a baby seal, with the biggest daily drop since February…

Source: Bloomberg

MAG7 stocks puked…

Source: Bloomberg

As 0-DTE traders dumped calls aggressively in MAG7 stocks…

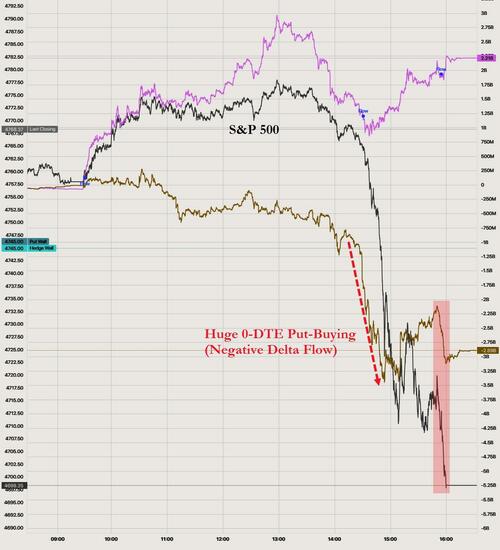

But there was a major 0-DTE S&P Put buyer (4755 Strike) that seemed that prompted the overall market to drop into negative gamma and sent the S&P spiralling below its Put Wall…

Goldman’s trading desk offered some color on the sudden drop:

Looking at S&P E-Mini’s, most volume started printing after 2:30pm, even prior to the break of 4800 and the pickup in volume was real.

The average run rate over the 45 minutes following the initial move was ~5x greater than earlier in the cash session.

There were a few headlines floating around as potential reason for the selloff, most notably: *GRAHAM: WILL DRAFT PRE-TAIWAN INVASION SANCTIONS AGAINST CHINA.

There was also a large put trade bought electronically (SPX 20Dec 4755) that was said to cause a short gamma hedging selloff.

Ultimately, market volumes are light and it does not take much to get this market moving… especially considering that SPX flirted with ATHs today.

It turns out VVIX was right to be worried…

Source: Bloomberg

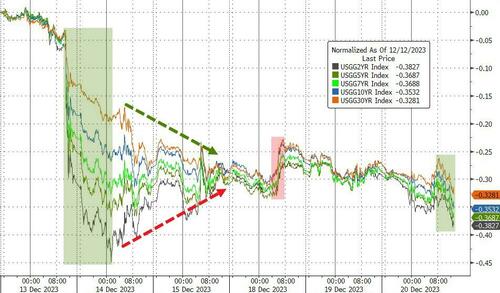

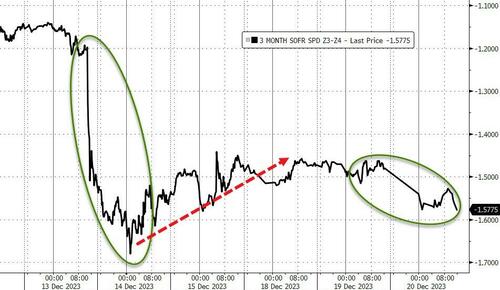

Treasuries were aggressively bid across the curve with the short-end outperforming today (30Y -6bps, 2Y -9bps). Since the FOMC, yields are down 33-38bps…

Source: Bloomberg

Despite the ugly 20Y auction, 30Y Yields tumbled back to test 4.00%…

Source: Bloomberg

The dollar rebounded, erasing most of yesterday’s losses…

Source: Bloomberg

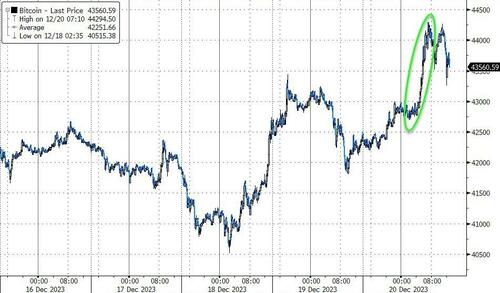

Bitcoin rallied back above $44,000…

Source: Bloomberg

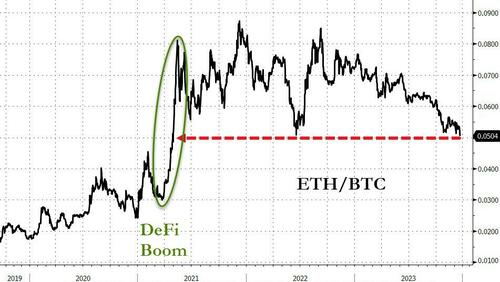

But Ethereum continues to underperform…

Source: Bloomberg

Gold drifted lower…

Oil prices ended lower after WTI topped $75 intraday…

Finally, bear in mind that VIX was not buying the last big squeeze higher in stocks…

Source: Bloomberg

And all that ‘cyclical’ love is a little decoupled from bonds view of the world…

Reality check time?

Tyler Durden

Wed, 12/20/2023 – 17:55

Source : https://www.zerohedge.com/markets/stocks-bond-yields-puke-rate-cut-expectations-surge

_1.png?itok=FdMuFo6G)