Trident Royalties: The Fast-growing Diversified Mining Royalty Company

Trident Royalties (AIM:TRR,OTC:TDTRF) provides investors with exposure to lithium, gold, copper, silver, iron ore, and other commodities (excluding thermal coal) through its diversified commodity portfolio. Trident is establishing itself as a royalty company using a unique royalty model that brings under its umbrella the entire gamut of the mining industry. This should attract investors willing to participate in the growth of metals such as lithium and copper, without taking the risk associated with investing directly in the mining companies themselves.

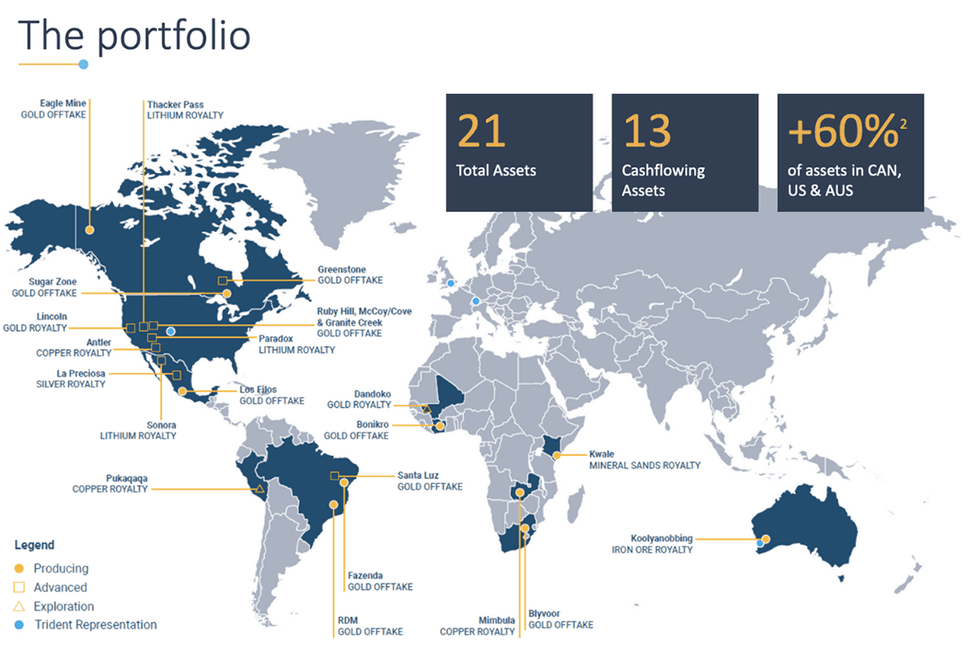

The company has acquired 21 assets (royalties and gold offtake agreements), of which 13 are currently cash-flowing. While the current revenue mix is weighted toward gold, asset-level developments across the portfolio, specifically at the Thacker Pass (lithium) and Mimbula (copper) projects, continue to indicate a higher mix of lithium and copper royalty revenue going forward. Thacker Pass is on track to be the largest lithium producer in North America within the next three years.

Trident has developed a portfolio that not only provides material revenue today but includes a tangible growth profile to significantly grow revenue over the next few years. A significant portion of future revenue is underpinned by assets already in construction, including Thacker Pass, Mimbula (in production, ramping-up) and Greenstone (discussed in detail below). Longer-term revenue growth is supported by a mix of expansions and new project development.

Company Highlights

- Trident Royalties is a diversified mining royalty company which provides investors with exposure to the full breadth of mining commodities, including precious, base and battery metals, and bulk/industrial minerals (excluding thermal coal). The company is listed on the AIM market of the London Stock Exchange under the ticker ‘TRR’ and on the US OTCQB market under the ticker ‘TDTRF’.

- Since its listing on London’s AIM market in June 2020, the company has acquired 21 assets, of which 13 are currently cash-flowing.

- The company’s broad asset base, which includes exposure to lithium, gold, copper, silver, iron ore and other commodities, differentiates it from its peers, which are mainly limited to precious metals.

- Greater than 60 percent of its asset NAV (by Unrisked Asset NAV – Tamesis Partners, 8 November 2023) is located in resource-friendly countries such as Canada, Australia and the US, which reduces jurisdictional risk.

- Management’s track record for value creation is impressive, delivering shareholder returns of 80 percent since listing.

- Trident has an attractive pipeline of future cash-flowing opportunities in battery and base metals. In particular, the Thacker Pass Lithium Project in the U.S. and the Mimbula Copper Project in Zambia hold significant potential for increased revenue to Trident. Thacker Pass is projected to deliver ~US$15 million in annual royalty revenue within the next three years (Revenue estimates by Tamesis Partners (8 November 2023)

This Trident Royalties profile is part of a paid investor education campaign.*

Click here to connect with Trident Royalties (AIM:TRR,OTC:TDTRF) to receive an Investor Presentation

Source : https://investingnews.com/trident-royalties-the-fast-growing-diversified-mining-royalty-company/